End-of-Year Checklist for Small Businesses: 11 Things to Do Before the Year Ends

Reflecting on the past year is an important step for small businesses. It allows you to evaluate your successes and figure out what worked well, while assessing the challenges you faced and helping pinpoint areas for improvement. Plus, making time to regroup and recharge can help you set clear business goals to start the new year strong.

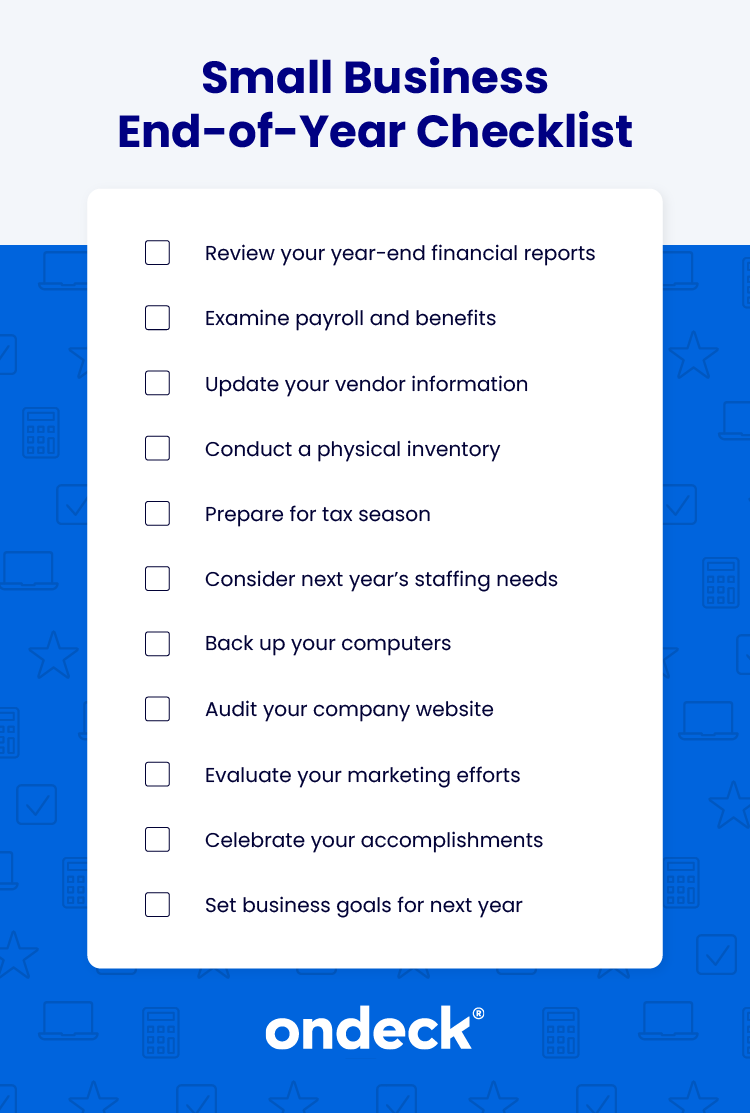

Since the end of the year is a hectic time for many small business owners, we’ve created a quick and easy checklist to help prioritize your tasks and make sure you get to the most important things.

Small Business End-of-Year Checklist

1. Run and review your year-end financial reports.

Your business’s financial health is important. With careful bookkeeping, reviewing certain financial records at the end of the year can give you valuable insights into your business’s performance. This can help you identify trends, assess profitability and make informed decisions about future growth. In addition to bank statements, here are some other financial statements you may want to review:

Profit and Loss. A profit and loss statement (also called an income statement) gives you a snapshot of your business’s financial situation. It summarizes revenues and business expenses over a specific period. If your profits are high, it may be time to consider investing in growth strategies. If profits are low, you may want to identify where to cut back on expenses.

Cash Flow Statement. Cash flow affects everything from day-to-day expenses to long-term planning. It shows how much cash you have on hand to meet your financial obligations. Creating a cash flow statement that captures every cash transaction can help you understand how well your business generates cash to fund operations, support investments and pay off debt. A positive cash flow means you have more money coming in than going out — while a negative cash flow can cause problems with operations.

Balance Sheet. A balance sheet is a type of financial statement that shows a company’s assets, liabilities and equity at a specific point in time. In other words, it’s the difference between what you own and what you owe. Assets can include things like accounts receivable, equipment and inventory. Liabilities can include things such as accounts payable, loans and other debt. Creating and reviewing this document at the end of the year can help you assess your company’s stability and liquidity to help plan future financial goals.

2. Examine payroll and benefits.

Your team is important to your business’s success. As the year comes to a close, take time to review your records to ensure that all your employees were paid correctly throughout the year. This can include verifying tax withholdings and benefits deductions. Additionally, it may be time to evaluate your compensation packages to see if they’re competitive enough to continue to attract and retain talent.

3. Update your vendor information.

The end of the year is also a good time to review your vendor information. If you onboarded any new vendors, double check that they got added to the system. Make sure you have the right contact details, payments terms, and product or service agreements on file. Verifying all this information can help prevent issues in the future.

4. Conduct a physical inventory.

If your small business sells physical products, year-end is a good time to conduct inventory. It can help you keep accurate year-to-year stock records. This task can show you trends, like slow-moving items or potential losses, and help you identify discrepancies in your records. You can use this information to adjust inventory levels, take advantage of sales and plan for the coming year.

5. Prepare for tax season.

Tax season can be stressful — but a little preparation goes a long way. Gather your financial records and other tax documents at the end of the year to help you prepare for your annual tax return filing. Be sure to record any tax-deductible items and expenses accurately for the IRS. You may also want to consult with a financial professional for any specific questions or concerns about your tax filings.

6. Consider next year’s staffing needs.

As your business grows, so do your staffing needs. Reflect on the last year and consider if there was a time that an extra hand or two could have helped out. Thinking about your staffing needs now allows you to plan effectively and hire the right person.

7. Back up your computers.

Whether it’s accounting software, point-of-sale systems or employee records, you want to make sure you don’t lose your data. Backing up your computers can be time consuming, but the information stored there is critical. Setting aside time at the end of the year can be a good way to ensure that backing up your technology doesn’t get overlooked.

8. Audit your company website.

Your website is often the first impression a customer will have of your business. Conducting an annual audit can help keep it fresh and functional. You may want to review the content, design and functionality. Look for outdated information and broken links. An updated site with a good user experience can provide a boost to customer engagement.

9. Evaluate your marketing efforts.

Small business marketing can help drive awareness and revenue. Look back over the last year and evaluate how well your marketing strategies performed. Identify what worked well for your business and what didn’t. Based on your findings, you can adjust your marketing plan to focus on the tactics that provide the best return for your business.

10. Celebrate your accomplishments.

The end of the year isn’t just about ticking off tasks and analyzing data — it’s also a time to celebrate everything you achieved during the year. Reflect on the goals you accomplished and recognize the team members who contributed.

Recognizing success can help build a positive company culture and motivate employees.

Consider throwing a year-end party to acknowledge all their hard work. Celebrating can help energize your team and prepare them to tackle the challenges and opportunities ahead.

11. Set business goals for next year.

After reviewing the past year, it’s time to look ahead. The insights and trends you discovered can help you set clear, achievable goals for business growth and success.

An annual operating plan can serve as a roadmap for the year ahead. Outline objectives for revenue, growth and operational improvements. You can break down large goals into actionable steps with timelines. You may also want to get your team involved in the goal-setting process to ensure alignment and shared commitment.

The Bottom Line

The end of the year can be a hectic time for small businesses. Working with a checklist can help ensure that you take care of the things you need to get done. It can help secure your company’s financial health, optimize operations and inspire your team for the future. For more in depth questions and personalized financial planning you may want to consider talking with a financial advisor.

See What Other Business Owners Check Off at the End of the Year

“1. Conduct a meeting with your tax advisor by mid-November to go through projected earnings for the year and to discuss any potential tax strategies that might be employed.

2. Prepare a detailed budget based on realistic assumptions for next year that help you feel like you’re playing a winnable game. In doing so, complete a listing of things that you should: a) stop doing, b) start doing and c) continue doing. This will help you shape where dollars get allocated in the budgeting process.

3. Make decisions you’ve been procrastinating about now that you’ve carved out the budget for them. In the words of Marcus Tullius Cicero, “More is lost by indecision than wrong decision.”

4. Take care of those that have taken care of you by distributing year-end bonuses and or gifts for employees and clients/customers.

5. Pretend that Thanksgiving is your year-end so that you can try to soak in as much of the holidays as possible before a fresh start in the new year!”

John Frank, CEO

Third Road

“Every year, I make sure to review and update all the contracts and agreements we have with suppliers and partners. This practice has helped me avoid unexpected surprises and ensures that all terms are favorable and accurate, reflecting any changes that have occurred over the past year. It’s crucial in maintaining strong relationships and setting clear expectations moving forward.

“Additionally, I perform a comprehensive financial analysis, checking for any possible discrepancies in cash flow or expenses compared to projections. This process provides insights that guide budget planning for the upcoming year. Through these steps, I’ve safeguarded my business’s interests and fostered a resilient operational foundation.”

Billy Rhyne, Founder/CEO

Horseshoe Ridge RV Resort

DISCLAIMER: This content is for informational purposes only. OnDeck and its affiliates do not provide financial, legal, tax or accounting advice.

Article Contributors

John Frank, CEO

John is the Founder & CEO of Third Road Management and is responsible for the firm’s overall directional leadership in addition to serving as a Fractional CFO for multiple Third Road Management clients.

Billy Rhyne, Founder/CEO

I'm Billy Rhyne, a passionate developer, travel expert and entrepreneur behind the Horseshoe Ridge RV Resort in the picturesque Texas Hill Country. With a background in finance from St. Edward's University, where I graduated Summa Cum Laude, I've built my career on strategic growth and operational excellence. I've held pivotal roles such as Vice President of Operations at Saltwater Lodge and Strategic Account Manager at SolarWinds, where I honed my skills in transforming businesses and exceeding targets.